Margin vs. Mark-Up: The Difference Is Significant.

Margin vs mark-up: the difference is significant.

However, the more projects we undertake at Ocius Digital, the more we realise that many of our clients don’t seem to understand exactly what this means – and the implications of getting it wrong.

It’s important to understand the difference, and to set up your systems to accurately reflect what your business is making, because when it comes to the crunch, the impact margin and mark-up can have on your bottom line is significant.

What exactly is the difference between margin and mark-up?

Today margin and mark-up are used interchangeably to represent gross margin. In actual fact, this misunderstanding could make or break your bottom line. Margin and mark-up are two very different things, and should be treated as such.

To be precise, mark-up refers to the percentage difference between the actual cost and the selling price. In contrast, margin is the percentage difference between the selling price and the profit.

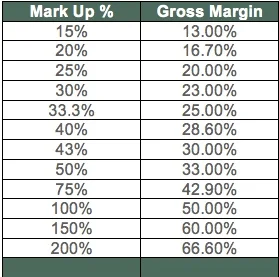

Whilst many believe that if a product or service is ‘marked up’, the result will be the same amount in gross margin, this is not actually the case.

Although mark-up is often used by operations and sales departments to set prices, it often exaggerates the profitability of the transaction. Mathematically, mark-up is always a larger number when compared to the gross margin.

As a result, many people think they are gaining a larger profit than is actually the case.

By calculating sales prices in terms of gross margin, it is possible to compare the profitability of the transaction to the economics of the financial statements in real terms.

What does this mean in real terms?

Let’s say, for example, your business overheads are 25% of sales.

To make a profit of 5% on sales, you must make a margin of 30%. This is not a mark-up of 30% – this would mean your margin is only 23%. If this was the case, rather than make a profit of 5% you would actually be losing 2%.

Let’s do the maths...

So, how do you determine the selling price based on a desired gross margin?

By simply dividing the cost of the product or service by the inverse of the gross margin equation, you will establish the selling price needed to achieve the desired gross margin percentage.

For example, if a product costs $100, the selling price with a 25% markup would be $125.

That is:

Gross Profit Margin = Sales Price – Unit Cost = $125 – $100 = $25.

Markup Percentage = Gross Profit Margin/Unit Cost = $25/$100 = 25%.

Sales Price = Cost X Markup Percentage + Cost = ($100 X 25%) + $100 = $125.

If a 25% gross margin percentage is required, the selling price would be $133.33, making the markup rate 33.3%.

Sales Price = Unit Cost/(1 – Gross Margin Percentage) = $100/(1 – 0.25) = $133.33

Markup Percentage = (Sales Price – Unit Cost)/Unit Cost = ($133.33 – $100)/$100 = 33.3%

It’s easy to see how companies get into trouble deriving prices if there is confusion about the meaning of margins and mark-ups, but for a small business, keeping track of your profit margin is critical. Don’t equate increased sales revenue with profitability. Many companies experience an increase in total revenue only to discover they have become less profitable.

By targeting margin versus mark-up you can add an additional 2 – 3 % profit to your bottom line.